Chargeback Fraud

Chargeback Fraud is when cardholders dispute a transaction with the bank instead of contacting the merchant for a refund. Sometimes called friendly fraud, it involves actual consumers abusing the chargeback process to secure a refund. Despite the wide range of excuses people may use, there is an increasing likelihood that these sorts of claims are false and the intent dishonest. Why would a customer misrepresent a transaction? There are multiple potential reasons, including:

Reasons a customer would misrepresent a transaction:

- The cardholder’s actual intention was to get something free.

- The cardholder simply did not understand the process.

- The cardholder experienced buyer’s remorse, regretting the purchase but not wanting to confront the merchant.

- A family member made the purchase, but the primary cardholder either didn’t know or simply didn’t want to honour the charges.

- The cardholder didn’t recognize the charge or forgot about making the purchase.

- The cardholder didn’t qualify for a traditional refund (for example, the time limit had passed).

Obviously, a certain number of claims filed will be legitimate, caused by merchant errors or criminal fraud. But the percentage of fraudulent chargebacks is growing exponentially each year.

The Challenges of Fighting Chargeback Fraud

More and more statistics back up the prevalence of chargeback fraud. So why isn’t something being done to stop this epidemic? There are several reasons consumers continue to get away with fraudulent chargebacks:

- Chargeback fraud Reason codes don’t accurately describe the transaction dispute. To file a chargeback, the cardholder must make a claim–in the case of fraud, a false claim–against a transaction. Banks assign a pre-defined reason code based on whatever reason the consumer provides for filing the dispute.

- Many merchants simply accept the assigned reason code as truth, and therefore do nothing to try and identify the actual cause of the chargeback. Unfortunately, this leaves them with no effective defence against chargeback fraud.

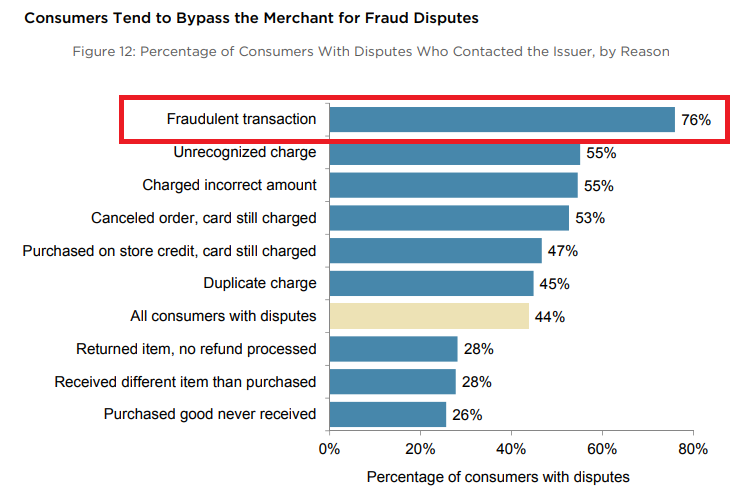

- Chargebacks are often easier than refunds. A recent study found 81% of cardholders have filed a chargeback out of convenience. Rather than contact the merchant, they decided it was easier and faster to ask the bank for a “refund.

- Chargeback regulations are largely obsolete. Chargeback regulations were developed in the pre-internet era. They were never designed to accommodate today’s fast-paced, computer-driven marketplace.

- Banks are unable (or unwilling) to perform due diligence. Like any other business, banks are interested in appeasing their customers. So when cardholders file a chargeback, banks tend to automatically assume the customer is right.

- Merchants lack the resources for fighting back. Successfully managing chargeback fraud is a difficult task. Do-it-yourself risk mitigation requires a large investment, yet statistically offers a minimal chance of success.

Our solution

chargebacks can cause problems far beyond simple revenue loss. Failing to fight back can have severe, long-term repercussions. And it can do irreparable damage to a business’s sustainability.

Join GlobePay and fight Chargeback! We can solve this problem once and for all! GlobePay Limited is a professional RMB cross-border payment solution provider in the UK. At GlobePay, we strive to provide the safest and fastest payment solutions for your business. We are a comprehensive payment platform that links Chinese clients to British businesses through WeChat Pay, Alipay, and Union Pay.

Both Alipay and WeChat pay do not support Chargebacks. As a result, all payments are guaranteed! Alipay and WeChat Pay will only re-credit the customers and debit the merchant if Alipay and WeChat Pay receive a customer complaint and there is evidence that you have compromised the security of that payment. Alipay and WeChat Pay are extremely popular payment methods that the Chinese use to make payments online or in-store from their mobile phone apps. With multi-billion users, Alipay and WeChat Pay handle most of China’s payments and transformed a cash market into a card-trusting market with their e-Wallets.